Banking and Insurance

Watch our introduction video for Banking and Insurance

Thanks for visiting the MA Insurance and Banking Pillar page.

The purpose of exploring this pillar is to go in-depth to the problems with banking and insurance and then discover solutions to those problems.

These solutions can result in true banking and insurance freedom for you and your family and provide cost effective and efficient sources.

Below are examples of problems that MA can help you with by offering you some proposed solutions.

Introduction to Problems and Solutions:

The modern financial system is plagued by a series of interconnected problems that disproportionately harm everyday citizens, creating cycles of debt, financial instability, and inequity. Central banks, corporate power, predatory lending, and hidden credit systems have ensnared many in a financial web that favors the wealthy and burdens everyday people. Banks profit from customer deposits, insurance companies deny rightful claims, and complex systems manipulate the financial opportunities available to individuals. These practices erode trust in financial institutions and undermine economic freedom.

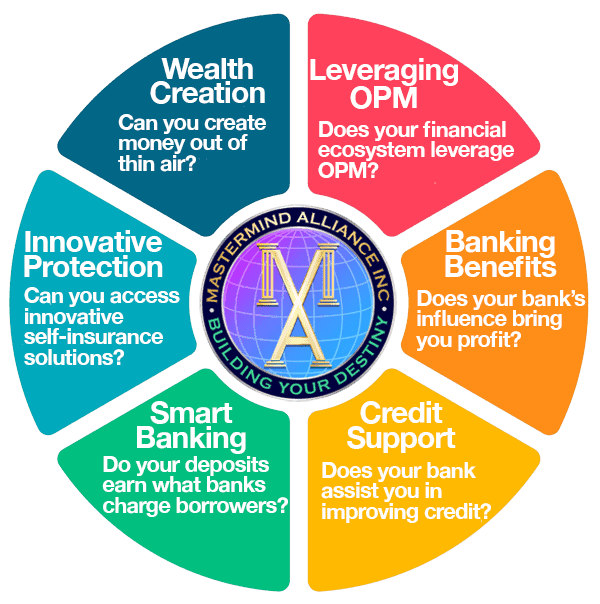

However, there is hope. Through innovative solutions and collective action, we can restore fairness, transparency, and accountability to the financial system. By empowering individuals with knowledge, promoting ethical financial models, and offering alternative pathways to financial security, we can break free from the grip of exploitative practices. The following solutions outline how these problems can be addressed, offering a way forward for a more equitable and transparent financial landscape through the Mastermind Alliance. To achieve financial freedom, we must focus on breaking free from the grip of financial oligarchs who have trapped the masses in perpetual debt. See chart below for illustrating our 6-point test.

Discover The Problems & Solutions

Problem: Central Banks Have Seized Control of the Money Supply

Banks can loan money at a 10 to 1 ratio of every dollar you deposit. They essentially are creating money out of thin air! The plan was hatched over a century ago when several key figures from America’s banking elite met at Jekyll Island, Georgia. After this historic meeting, the Federal Reserve was born. This is when our monetary system was taken over and the dollar was removed from the gold standard. This has led to rampant inflation, devaluing the dollar, and making necessary financing for larger purchases such as auto and home loans less affordable for the average consumer. The rich are getting richer while the poor are getting poorer!

Solution:

To counter central bank control and restore fairness, the U.S. should return to sound money principles by exploring asset-backed currencies or alternatives like decentralized digital currencies. Strengthening financial literacy, enforcing transparency in lending practices, and limiting fractional-reserve banking can reduce artificial money creation. Supporting credit unions and community banks over large institutions can decentralize financial power. Finally, policy reform that ties money supply growth to real economic output—not political agendas—can help stabilize inflation and protect consumer purchasing power. MA will establish strong partnerships with small state banks and credit unions to support the broader goal of decentralizing the banking system. By collaborating with these community-focused institutions, MA will help shift financial power away from large centralized banks. At the same time, MA will develop a unique banking framework that empowers its members to function as their own bank—giving them greater control over their finances, savings, and lending capabilities within a trusted and member-driven financial ecosystem. All of this can be done while still leveraging and operating within our existing financial system.

Problem: Lobbying and Political Influence Wield Control Over The Little Guy

The problem with banks controlling the government lies in the erosion of democratic principles and the prioritization of corporate profit over public welfare. When financial institutions influence lawmakers through lobbying, campaign contributions, and revolving-door employment, policies are often crafted to benefit the banking sector, often at the expense of consumer protection and financial freedom. This results in deregulation, tax loopholes, and bailouts that favor the wealthy while increasing economic inequality. Public trust declines as citizens see their needs ignored in favor of corporate agendas. Ultimately, such control undermines transparency, weakens government accountability, and threatens the stability of both the economy and the democratic process.

Solution:

MA will combat undue banking influence by advocating for campaign finance reform, transparency in lobbying, and stricter regulations on conflicts of interest in government. Members will be encouraged to support candidates who prioritize financial fairness and accountability. MA will also promote grassroots political engagement, financial education, and cooperative economic models that reduce reliance on big banks. By empowering members to make informed choices and back policy reform, MA aims to restore democratic balance and protect public interests from corporate overreach.

Problem: Predatory Lending and Hidden Fees Are Major Tactics Used By Banks

They cleverly and legally exploit vulnerable individuals. By offering high-interest loans with confusing or deceptive terms, banks trap borrowers in cycles of debt that are difficult to escape. Hidden fees, such as overdraft charges or late payment penalties, are often buried in fine print, making them hard to detect and avoid and they are often used as their core business model for generating profits. These practices disproportionately affect low-income communities, exacerbating financial instability and widening the wealth gap. Instead of providing fair financial services, banks prioritize profit, often at the expense of those least able to afford it.

Solution:

To combat predatory lending and hidden fees, reforms are needed to ensure clearer, more transparent loan terms with full disclosure of all fees upfront. Legislation should enforce strict limits on interest rates and fees, especially for high-risk borrowers. Financial education programs can empower individuals to better understand their rights and avoid exploitative practices. Additionally, supporting alternatives like credit unions and community lenders can provide fairer financial options, reducing reliance on predatory banks and helping vulnerable communities achieve greater financial stability. By partnering with a network of smaller banks and credit unions, MA will offer financial services that bypass hidden fees and exploitative charges commonly found with large lenders. These institutions will uphold transparency, fairness, and consumer protection in all transactions, while enabling MA members to engage safely and confidently in a stronger, more equitable financial system.

Problem: Credit Bureaus Have Significant Power To Manipulate Your Credit Score

Credit and risk scores significantly impact access to loans, housing, and employment, yet these systems are often opaque, flawed, and easily manipulated. Banks and financial institutions use complex algorithms that lack transparency. They make it difficult for individuals to understand how their credit score is calculated, and they have little knowledge on the best practices and methods to employ in order to raise their scores, or dispute their scores. Small errors or biased data can seriously harm a person’s financial standing, often without their awareness, and most people have little understanding of how to identify, challenge, or correct these mistakes. This lack of accountability allows banks to control financial opportunity while leaving citizens with little recourse to correct or challenge unfair evaluations.

Solution:

To address the flaws in credit scoring, stronger regulations are needed to ensure transparency, accuracy, and accountability in reporting. Public education on credit management and simplified dispute processes can empower individuals to understand, monitor, and correct errors, reducing the undue influence of flawed algorithms on financial opportunity and access. MA will equip its members with essential tools and resources to improve credit scores, offering education, personalized guidance, and proven strategies to strengthen their financial profiles and enhance their ability to access credit successfully.

Problem: Banks Charge The Consumer To Borrow Their Own Money

This highlights a major fundamental flaw in the financial system. When individuals deposit money, banks use those funds to generate profit through loans and investments. Yet, when those same individuals seek a loan or credit, they are charged high interest rates and various fees. Essentially, people are paying to access the very money they helped supply. This creates a system where banks profit twice—first from using customer deposits, and second from charging those customers to borrow. It reinforces inequality, as average consumers bear the cost while banks accumulate wealth with minimal accountability.

Solution:

A fairer financial system requires greater transparency, equitable lending practices, and alternatives to traditional banking. Supporting credit unions and community banks, enforcing caps on interest rates and fees, and promoting public banking models can help ensure that consumers benefit from their deposits rather than being charged to access their own money. Moreover, MA will implement a transformative banking system that allows members to earn interest on their own deposits, shifting the financial advantage back to the individual and redefining how value is generated and shared in the banking sector.

Problem: Debt Dependency Is Enslaving Millions Of People

Debt dependency is a powerful tool used by financial institutions to maintain control over individuals, businesses, and even governments. By promoting a system built on constant borrowing, they ensure that people remain trapped in cycles of repayment and interest. Loans, credit cards, and deficit financing are marketed as necessities, not choices, creating long-term obligations. This constant state of debt limits financial freedom, reduces bargaining power, and keeps the average person reliant on banks for survival, reinforcing a system of economic control and dependence.

Solution:

Breaking free from debt dependency requires financial education, access to low-interest alternatives, and encouragement of savings over borrowing. Policies that cap predatory interest rates, promote responsible lending, and support community-based financial models can empower individuals to build wealth, reduce reliance on debt, and reclaim control over their economic futures. MA will empower its members to reclaim their wealth by collectively pooling resources and establishing a member-driven financial network—creating a banking system within a banking system that prioritizes shared growth, self-reliance, and long-term financial empowerment.

Problem: Denial Of Legitimate Insurance Claims and Coverage Is Commonplace

Insurance companies often deny valid claims or create excessive hurdles that make it extremely difficult for individuals to receive the compensation they are entitled to. This may involve complex paperwork, long delays, vague policy language, or requiring documentation that is hard to obtain. These tactics are designed to wear down claimants, causing many to abandon their claims altogether or accept unfairly low settlements. As a result, policyholders who believed they were protected are left financially vulnerable during emergencies, undermining the very purpose of having insurance coverage.

Solution:

To address unfair denial of insurance claims, stronger consumer protection laws, standardized policy language, and streamlined claims processes are essential. Independent oversight and transparent appeals systems can hold insurers accountable, while public education empowers policyholders to understand their rights and pursue fair compensation without being misled or worn down by obstacles. MA members will work together to promote transparency in policy language and establish independent advocacy to demand greater accountability from insurers and stronger protections for members. Additionally, MA will develop innovative self-insurance solutions through collective member contributions, offering greater financial security and autonomy within a trusted community framework.